Payslip Distribution Database Design

Introduction

Table of Contents

Managing employee payslips efficiently is crucial for any organization. This tutorial provides a comprehensive guide to designing a Payslip Distribution Database. A well-structured database ensures accurate and timely management of employee salary information, bonuses, and deductions, which is essential for maintaining employee satisfaction and compliance with legal requirements.

Purpose and Importance of a Payslip Distribution Database

A Payslip Distribution Database is designed to store and organize all the information related to employee compensation. This includes details such as basic salary, bonuses, deductions, and the final payslip issued to employees. By using a database, companies can automate the process of payslip generation, reduce errors, and streamline payroll management. This not only saves time but also provides a secure and reliable way to manage sensitive employee information.

Benefits of a Well-Structured Database in Managing Employee Payslips

- Accuracy: A well-organized database reduces the risk of errors in calculating salaries, bonuses, and deductions.

- Efficiency: Automating the payslip generation process saves time and effort for HR professionals and payroll managers.

- Security: Sensitive employee data is securely stored and accessed only by authorized personnel.

- Scalability: A good database design can easily accommodate the growth of the company, handling more employees and complex payroll structures as needed.

- Compliance: Ensures that all payroll operations comply with local laws and regulations, avoiding potential legal issues.

Target Audience

This tutorial is designed for individuals and professionals involved in payroll management and database design:

- HR Professionals: Learn how to streamline payroll operations and manage employee compensation efficiently.

- Payroll Managers: Discover how to implement a reliable system for handling salaries, bonuses, and deductions.

- Database Administrators: Understand the best practices for designing a database that meets the needs of payroll management.

- Developers: Gain insights into building and maintaining a payroll database system.

Whether you’re setting up a new payroll system or looking to improve an existing one, this tutorial will provide the necessary steps and best practices to design a Payslip Distribution Database that meets your organization’s needs.

Understanding Payslip Distribution Requirements

A payslip is a formal document that details an employee’s earnings and deductions for a specific pay period. It serves as a crucial record for both the employee and the employer. Payslips provide a clear breakdown of:

- Income: Basic salary, allowances, bonuses, and other earnings.

- Deductions: Taxes, insurance premiums, loan repayments, and other deductions.

- Net pay: The amount of money the employee receives after deductions.

Payslips are essential for several reasons:

- Compliance: They are required by law in many jurisdictions.

- Employee records: They serve as important records for employment history and tax purposes.

- Financial planning: Employees can use payslips to track their income and expenses.

Key Components Typically Included in a Payslip

A typical payslip includes the following components:

- Employee information: Name, employee ID, department, and job title.

- Pay period: Start and end dates of the pay period.

- Gross earnings: The total amount earned before deductions.

- Deductions: Taxes, insurance premiums, loan repayments, and other deductions.

- Net pay: The amount of money the employee receives after deductions.

- Year-to-date totals: Accumulated earnings and deductions for the year.

Web-based Payroll System Free Download Template in Bootstrap

Importance of Organizing Employee Data and Payroll Records

Organizing employee data and payroll records is crucial for efficient payslip distribution and accurate financial reporting. A well-structured database can help:

- Streamline payroll processing: Automate calculations and reduce manual errors.

- Ensure compliance: Maintain accurate records for tax and regulatory purposes.

- Facilitate employee inquiries: Provide quick access to payslip information.

- Improve data security: Protect sensitive employee data from unauthorized access.

By understanding the requirements for payslip distribution and organizing employee data effectively, you can create a reliable and efficient payroll system.

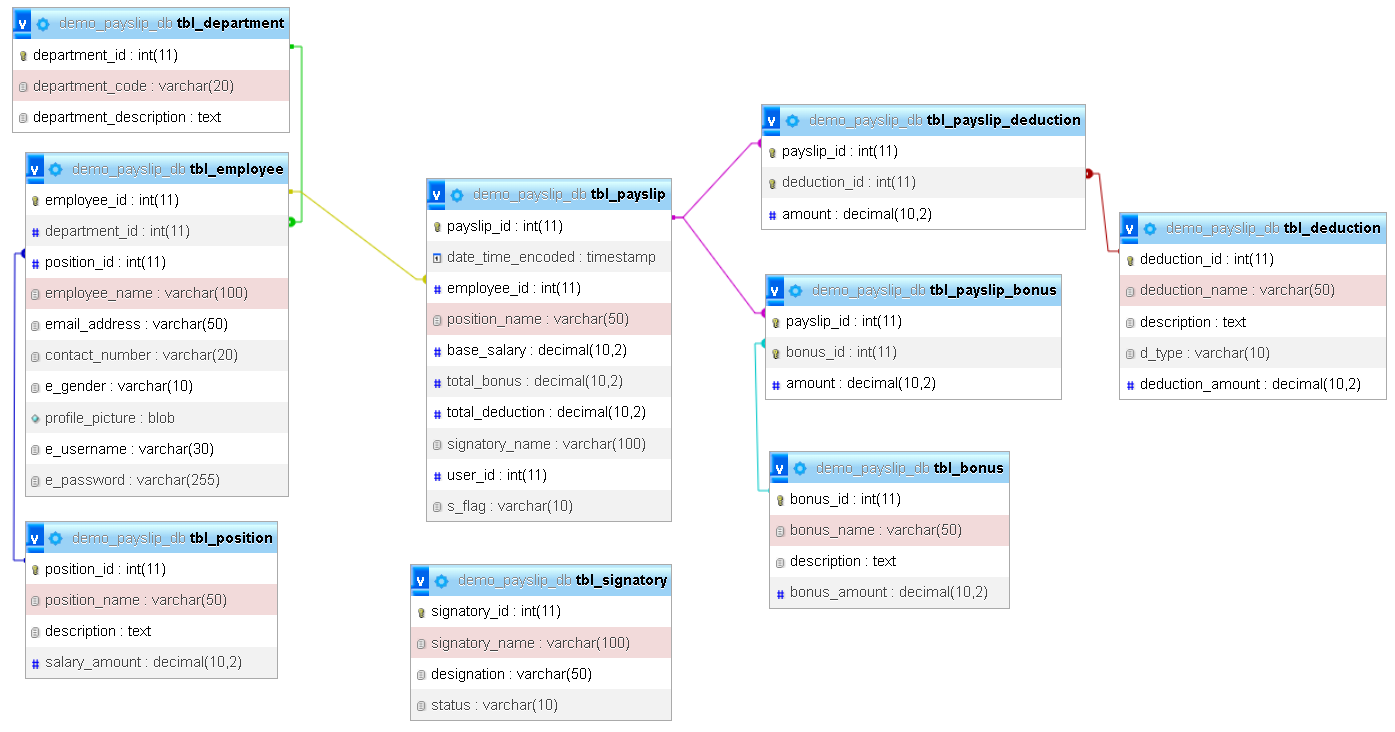

Detailed Breakdown of Each Database Table

Department Table (tbl_department)

- Purpose: To store information about different departments within the company.

- Columns:

- department_id: Primary key, unique identifier for each department.

- department_code: Code representing the department.

- department_description: Detailed description of the department.

Position Table (tbl_position)

- Purpose: To store job positions and their corresponding salary details.

- Columns:

- position_id: Primary key, unique identifier for each position.

- position_name: Name of the job position.

- description: Description of the position’s role.

- salary_amount: Base salary for the position.

Employee Table (tbl_employee)

- Purpose: To store detailed employee information.

- Columns:

- employee_id: Primary key, unique identifier for each employee.

- department_id: Foreign key linking to the department the employee belongs to.

- position_id: Foreign key linking to the employee’s position.

- employee_name: Name of the employee.

- email_address: Employee’s email address.

- contact_number: Employee’s contact number.

- e_gender: Gender of the employee.

- profile_picture: Profile picture of the employee.

- e_username: Username for employee login.

- e_password: Password for employee login.

Bonus Table (tbl_bonus)

- Purpose: To store various types of bonuses employees may receive.

- Columns:

- bonus_id: Primary key, unique identifier for each bonus type.

- bonus_name: Name of the bonus.

- description: Description of the bonus.

- bonus_amount: Amount of the bonus.

Deduction Table (tbl_deduction)

- Purpose: To store different types of deductions applicable to employees.

- Columns:

- deduction_id: Primary key, unique identifier for each deduction type.

- deduction_name: Name of the deduction.

- description: Description of the deduction.

- d_type: Type of deduction (amount or percentage).

- deduction_amount: Amount of the deduction.

Payslip Table (tbl_payslip)

- Purpose: To store payslip records for employees.

- Columns:

- payslip_id: Primary key, unique identifier for each payslip.

- date_time_encoded: Timestamp when the payslip was generated.

- employee_id: Foreign key linking to the employee who receives the payslip.

- position_name: Position of the employee (denormalized for easy access).

- base_salary: Base salary of the employee.

- total_bonus: Total bonus amount for the payslip.

- total_deduction: Total deduction amount for the payslip.

- signatory_name: Name of the person who approved the payslip.

- user_id: ID of the user who generated the payslip.

- s_flag: Status of the payslip (new or old).

Payslip Bonus Table (tbl_payslip_bonus)

- Purpose: To record bonuses linked to specific payslips.

- Columns:

- payslip_id: Foreign key linking to the payslip.

- bonus_id: Foreign key linking to the bonus type.

- amount: Amount of the bonus.

Payslip Deduction Table (tbl_payslip_deduction)

- Purpose: To record deductions linked to specific payslips.

- Columns:

- payslip_id: Foreign key linking to the payslip.

- deduction_id: Foreign key linking to the deduction type.

- amount: Amount of the deduction.

Signatory Table (tbl_signatory)

- Purpose: To store information about signatories who approve payslips.

- Columns:

- signatory_id: Primary key, unique identifier for each signatory.

- signatory_name: Name of the signatory.

- designation: Job title or role of the signatory.

- status: Active or inactive status (only one active signatory at a time).

Relationships Between Tables

Understanding the relationships between tables in a database is essential for ensuring data integrity and efficient querying. Below is a detailed discussion of how the tables in the Payslip Distribution Database are related to each other, using primary and foreign key relationships.

- Department Table (tbl_department) and Employee Table (tbl_employee)

- Relationship Type: One-to-Many

- Description: Each department can have multiple employees, but each employee belongs to only one department. This relationship is represented by the department_id column in the tbl_employee table, which is a foreign key linking to the department_id in the tbl_department table.

- Position Table (tbl_position) and Employee Table (tbl_employee)

- Relationship Type: One-to-Many

- Description: Similar to departments, each job position can have multiple employees, but each employee has only one position. The position_id column in the tbl_employee table serves as a foreign key, linking to the position_id in the tbl_position table.

- Employee Table (tbl_employee) and Payslip Table (tbl_payslip)

- Relationship Type: One-to-Many

- Description: An employee can have multiple payslips over time, representing different payroll periods. Each payslip is associated with one employee. This relationship is managed through the employee_id column in the tbl_payslip table, which is a foreign key linking to the employee_id in the tbl_employee table.

- Payslip Table (tbl_payslip), Payslip Bonus Table (tbl_payslip_bonus), and Bonus Table (tbl_bonus)

- Relationship Type: Many-to-Many (implemented via a bridge table)

- Description: A payslip can have multiple bonuses, and a specific type of bonus can appear on multiple payslips. This many-to-many relationship is handled through the tbl_payslip_bonus table, which uses foreign keys payslip_id (linking to tbl_payslip) and bonus_id (linking to tbl_bonus). The amount column specifies the bonus amount applied for each specific payslip.

- Payslip Table (tbl_payslip), Payslip Deduction Table (tbl_payslip_deduction), and Deduction Table (tbl_deduction)

- Relationship Type: Many-to-Many (implemented via a bridge table)

- Description: Similar to bonuses, a payslip can have multiple deductions, and a specific deduction type can apply to multiple payslips. This relationship is managed by the tbl_payslip_deduction table, which contains foreign keys payslip_id (linking to tbl_payslip) and deduction_id (linking to tbl_deduction). The amount column records the deduction amount applied to each payslip.

- Signatory Table (tbl_signatory) and Payslip Table (tbl_payslip)

- Relationship Type: One-to-Many

- Description: Each payslip is signed off by one signatory, but a signatory may approve multiple payslips. The signatory’s information, such as signatory_name, is recorded directly in the tbl_payslip table for denormalization purposes. The signatory_id in the tbl_signatory table can be linked to the payslip to track which signatory approved which payslip.

- User Role in Payslip Creation (User ID in tbl_payslip)

- Relationship Type: Implied Relationship

- Description: The user_id in the tbl_payslip table indicates which user generated or encoded the payslip. This is crucial for tracking changes and maintaining a log of payroll operations. Although the user_id is not directly tied to a table in the current schema, it typically references an entry in a user or admin table (not specified in this design).

Implementing the Database Design

In this section, we will provide a step-by-step guide to create the payslip distribution database and its tables using SQL. We will also include SQL scripts to create each table, ensuring proper constraints like primary keys and foreign keys are implemented to maintain data integrity.

Step-by-Step Guide to Creating the Database and Tables

- Set up the Database Environment:

- Ensure you have a database management system (DBMS) installed (e.g., MySQL, PostgreSQL).

- Access the DBMS via a command line interface or a GUI tool (e.g., phpMyAdmin, MySQL Workbench).

- Create the database

CREATE TABLE tbl_department ( department_id INT PRIMARY KEY AUTO_INCREMENT, department_code VARCHAR(20), department_description TEXT ); CREATE TABLE tbl_position ( position_id INT PRIMARY KEY AUTO_INCREMENT, position_name VARCHAR(50), description TEXT, salary_amount DECIMAL(10,2) ); CREATE TABLE tbl_employee ( employee_id INT PRIMARY KEY AUTO_INCREMENT, department_id INT, position_id INT, employee_name VARCHAR(100), email_address VARCHAR(50), contact_number VARCHAR(20), e_gender VARCHAR(10), profile_picture BLOB, e_username VARCHAR(30), e_password VARCHAR(255), FOREIGN KEY (department_id) REFERENCES tbl_department(department_id), FOREIGN KEY (position_id) REFERENCES tbl_position(position_id) ); CREATE TABLE tbl_bonus ( bonus_id INT PRIMARY KEY AUTO_INCREMENT, bonus_name VARCHAR(50), description TEXT, bonus_amount DECIMAL(10,2) ); CREATE TABLE tbl_deduction ( deduction_id INT PRIMARY KEY AUTO_INCREMENT, deduction_name VARCHAR(50), description TEXT, d_type VARCHAR(10), deduction_amount DECIMAL(10,2) ); CREATE TABLE tbl_payslip ( payslip_id INT PRIMARY KEY AUTO_INCREMENT, date_time_encoded TIMESTAMP DEFAULT CURRENT_TIMESTAMP, employee_id INT, position_name VARCHAR(50), base_salary DECIMAL(10,2), total_bonus DECIMAL(10,2), total_deduction DECIMAL(10,2), signatory_name VARCHAR(100), user_id INT, s_flag VARCHAR(10) DEFAULT 'new', FOREIGN KEY (employee_id) REFERENCES tbl_employee(employee_id) ); CREATE TABLE tbl_payslip_bonus ( payslip_id INT, bonus_id INT, amount DECIMAL(10,2), PRIMARY KEY (payslip_id, bonus_id), FOREIGN KEY (payslip_id) REFERENCES tbl_payslip(payslip_id), FOREIGN KEY (bonus_id) REFERENCES tbl_bonus(bonus_id) ); CREATE TABLE tbl_payslip_deduction ( payslip_id INT, deduction_id INT, amount DECIMAL(10,2), PRIMARY KEY (payslip_id, deduction_id), FOREIGN KEY (payslip_id) REFERENCES tbl_payslip(payslip_id), FOREIGN KEY (deduction_id) REFERENCES tbl_deduction(deduction_id) ); CREATE TABLE tbl_signatory ( signatory_id INT PRIMARY KEY AUTO_INCREMENT, signatory_name VARCHAR(100), designation VARCHAR(50), status VARCHAR(10) );

Conclusion

This tutorial has provided a comprehensive guide on designing and implementing a Payslip Distribution Database. We have covered the following key points:

- Understanding Payslip Requirements: We explored the essential components of a payslip and the importance of organizing employee data.

- Database Table Design: We defined the necessary tables, their columns, and relationships to store payslip-related information.

- Implementing the Database: We provided SQL statements to create the database and tables, including primary and foreign keys.

Benefits of the Implemented Database Design

By following the outlined database design, you can achieve several benefits:

- Efficient Payslip Distribution: The database provides a centralized repository for managing payslip data, streamlining the distribution process.

- Accurate Calculations: The structured data enables accurate calculations of earnings, deductions, and net pay.

- Data Security: The database can be configured with appropriate security measures to protect sensitive employee information.

- Scalability: The design allows for easy expansion to accommodate future growth and changes in your organization.

Suggestions for Further Improvements or Scaling the System

- Data Validation: Implement data validation rules to ensure the accuracy and consistency of data entered into the database.

- Performance Optimization: Consider indexing frequently queried columns and optimizing database queries for improved performance.

- Integration with Other Systems: Explore integration possibilities with other HR systems, such as payroll software or time and attendance systems.

- Reporting and Analytics: Develop reports and analytics capabilities to gain insights into payroll data and identify trends.

- Security Enhancements: Regularly review and update security measures to protect against evolving threats.

By addressing these areas, you can further enhance the functionality and effectiveness of your Payslip Distribution Database.

Readers are also interested in:

You may visit our Facebook page for more information, inquiries, and comments. Please subscribe also to our YouTube Channel to receive free capstone projects resources and computer programming tutorials.

Hire our team to do the project.