Lending Management System Capstone Project

Proposed System

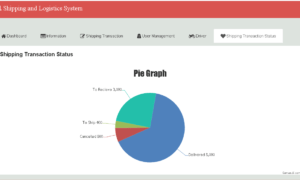

The proposed system entitled Lending Management System aims to make convenience for the transaction involving lending and using this system only requires less effort for the lender, easier and faster to manage. This kind of system will facilitate underwriting of proposals, dynamic uploading of documents, create user accounts and offer a collaboration framework for lenders.

The Lending Management System has unique characteristics which are simple, intuitive and proactive and this system handles different types of borrower and security of users’ documents. Through this system, lending processes will be hassle-free; they will not need to go physically to the lending offices to process but instead they will just utilize this system.

The proposed Lending Management System is also fast, flexible, and agile while being cost effective. The Lending Management System can also provide comprehensive web based platform that can manage every lenders. This system helps improvement, improving running of time and better services for the lenders. It helps banks and financial institutions to improve their, activities, competency, and efficiency of their lending solutions.

System Implementation

Lending Management System was developed by the researchers to solve the problems and difficulties encountered in the transactions in the manual system. The users of this system can have a secured account and the lenders are no longer to make an effort for the every transaction they must do. If this system was be implemented, it would make their works easier and faster to manage. It can improve their current kind of services. The institution will be no longer to make an effort to for every transaction.

The proposed Lending System was presented to the end users. The members from the group researchers provided questionnaire to answered questions, clarification and difficulties that might be encountered upon operating the system.

This system developed to scale with the growing user base and it is high security of data. The Lending Management System is completely, customize-able as per user’s preferences.

Objectives of the study

- To provide fast, flexible, and agile lending system while being cost effective.

- Faster and easier system management and cost a less of time.

- To provide a secure account and scalable solutions.

- Enhanced operations and service levels with optimal cost.

- To innovate manual system that is easy to manage.

Significant of the study

The management, the costumers, and the proponent will gain benefit from this study.

Management .When this study results excellent this will lead to more improvement of the business process because it can help the institution to improve their activities and for lending solutions.

Lenders. Using the system will help their transaction easier and faster. Cost rreduction and faster lending approval using this technology/services.

Proponent. If this research success the proponent will significantly benefit from it and analyze their knowledge for making the system.

Project Plan/SDLC Model

In this study, the researchers used the software development life cycle (SDLC). A model that have different processes and must associated with variety of task and activities. In this project the researchers only use six steps.

First, requirements identification. Which the researchers identify all the significant requirements for the system.

Second is gathering data. The researchers make an interview in the institutions and organizations to gather important information for the system.

Third stage is analyzing data. The data must be analyzed by the researchers to be able to identify the significant important information in the development of the system.

Fourth stage is system designing. The researchers designed the system that can cross to future needs of the users.

Fifth, is coding. The researchers will be encoding the codes and also to be tested if the codes are suit to that system and to make sure it is free of bugs and adheres the system.

You may visit our Facebook page for more information, inquiries, and comments. Please subscribe also to our YouTube Channel to receive free capstone projects resources and computer programming tutorials.

Hire our team to do the project.