Cash loan and Pawning Monitoring System with SMS Using PHP

Project Context

Table of Contents

Technology has a significant impact on business. Many businesses that compete in the business sphere are increasingly using it. Individuals and businesses have developed an interest in providing cash loans and creating loans for borrowers. People are turning to cash loans and pawning because of the expanding economies and rising prices of the present. Giving the data indicates that the businesses that create and conduct cash loan and pawning systems make it challenging for them to monitor and operate since they are unable to manage the process with only manual processing. Researchers in this case created a platform that takes into account the challenges faced by owners of the cash and pawning industries. The researchers create a piece of technology called “Cash Loan and Pawning Monitoring System SMS using PHP” that streamlines the industry’s monitoring procedures. The deployment of this system is crucial for business because it will aid in membership growth. This can save time and assist in keeping track of incoming and departing transactions. Additionally, this system may provide reports as needed and offer backup records for all transactions. The system includes SMS features that keep users informed about their cash loans and pawning operations, so they won’t be left behind. Additionally, the admin can actually conveniently and hassle-free remind the members.

The company’s issue is the manual updating of loan and credit due dates, which is difficult to manage, takes a lot of time, and is very annoying for every employee. Additionally, the existing system cannot immediately respond to every customer’s requests. However, the system will ensure that everything is covered. The system will automate transactions and replace or convert the manual loaning process. This system features a capability that may update and send text messages to cooperative members to remind them of their loan and credit due dates. This system can receive and send text messages to cooperative members for updates on their account deposits and for the timing reservation of withdrawals when it is available or not to have their transaction in order to avoid penalties.

Objectives of the Study

General Objective – The study’s primary goal is to develop an effective and manageable SMS Cash Loan and Pawning Monitoring System.

The study specifically seeks to:

- To transform debt administration from a manual procedure into a structured platform.

- In order to update members and clients, it is necessary to integrate SMS notification into the information system.

- Facilitating simple and convenient loan transactions for employees and members

- To make it easier for management to deal with loans for members and to inform them.

- To be able to complete the assignment successfully and to carry out the operations quickly.

Significance of the Study

The specific target of this system study is benefited by this investigation.

Employees. The promotion of a positive workplace culture and each employee’s motivations will be a major goal of this study. The system will provide the report form, so employees won’t have to bother about preparing it for the management.

Business/Cooperative. This study supports improved business processing and quality while boosting revenue and productivity.

Customer/Member. Offers customers simple access during every loan transaction. Send client updates and information via SMS. They are able to use the item they pawn to pay back their loans.

Future Researchers. The project is thought to still need a great deal of enhancements and improvements. Future researchers can build on this research as a model, make improvements, and include new features.

Features of the System

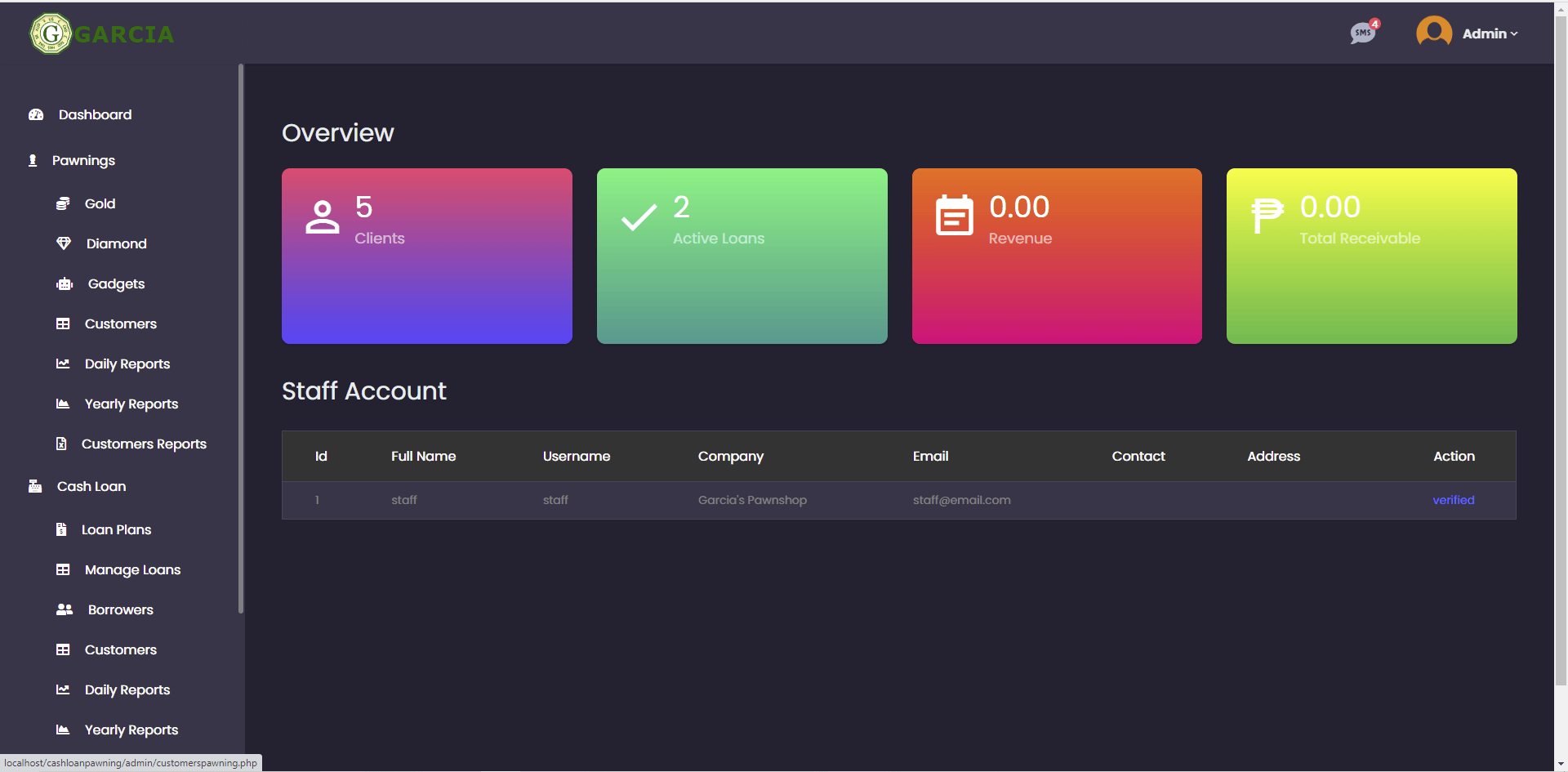

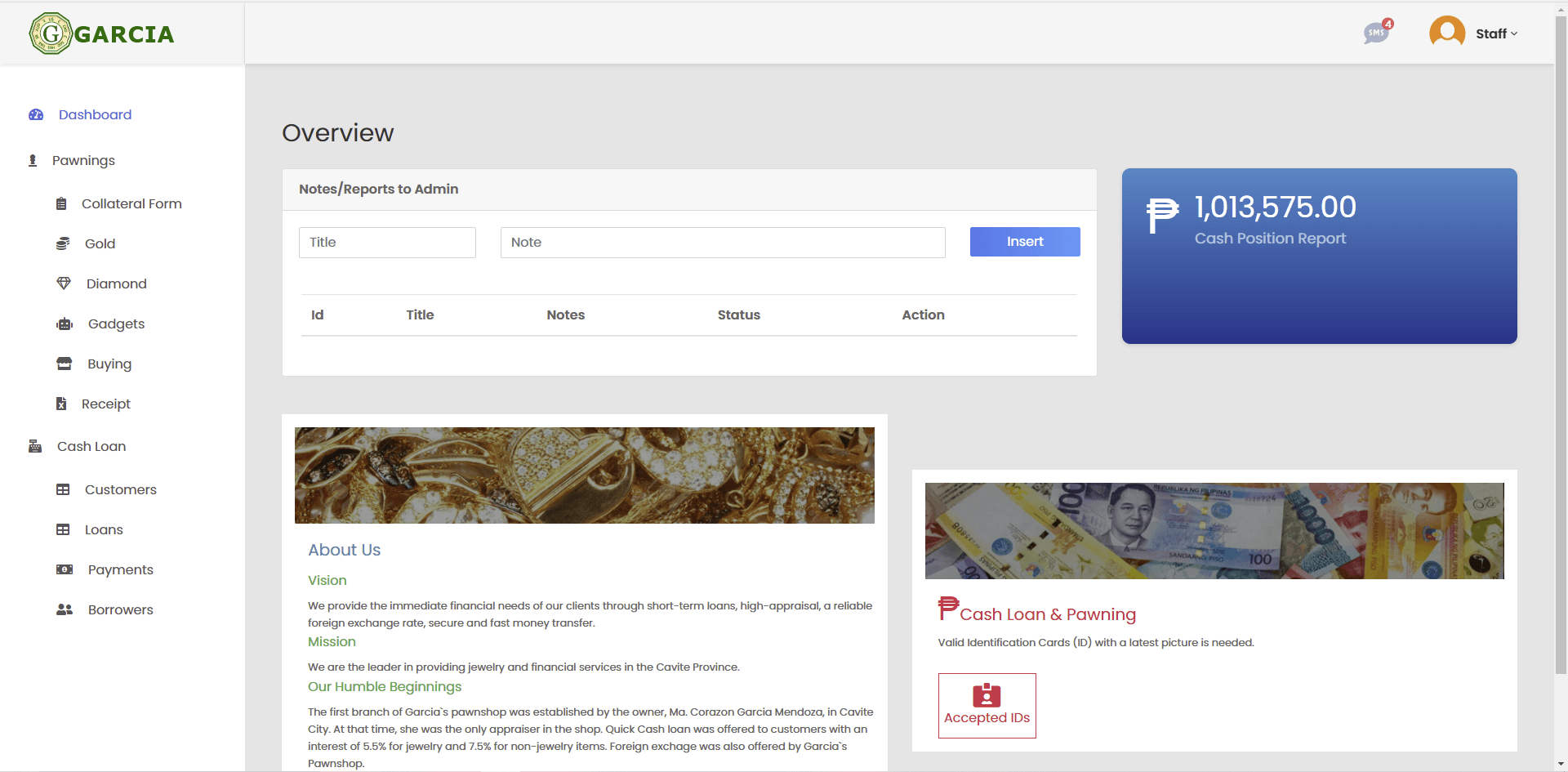

- Dashboard. The dashboard would serve as the administrator’s home page after logging in.

- Loan Management a function that oversees member loans, where users can view and locate loan-related information. It displays loan services, paperwork, steps, and other loan-related activities

- Pawn Management. All records of transactions in pawning services must be entered here, and this module must contain the information necessary to administer the appraisal and pawning services and transactions.

- Customer Information Management. This handles both the consumers using pawning services and the members who enquire about loans. Here, their data is saved.

- Loan Plans. This session explains the various loan plans, the process for applying, and the advantages of getting loans.

- Cash Loans Reports(daily, weekly, monthly). This module presents combined results for both pawning and loan services. The cash loans reports provide information about the number of cash loans, how much money was lent and how much money was repaid by borrowers. These reports also show the average interest rate for each type of loan.

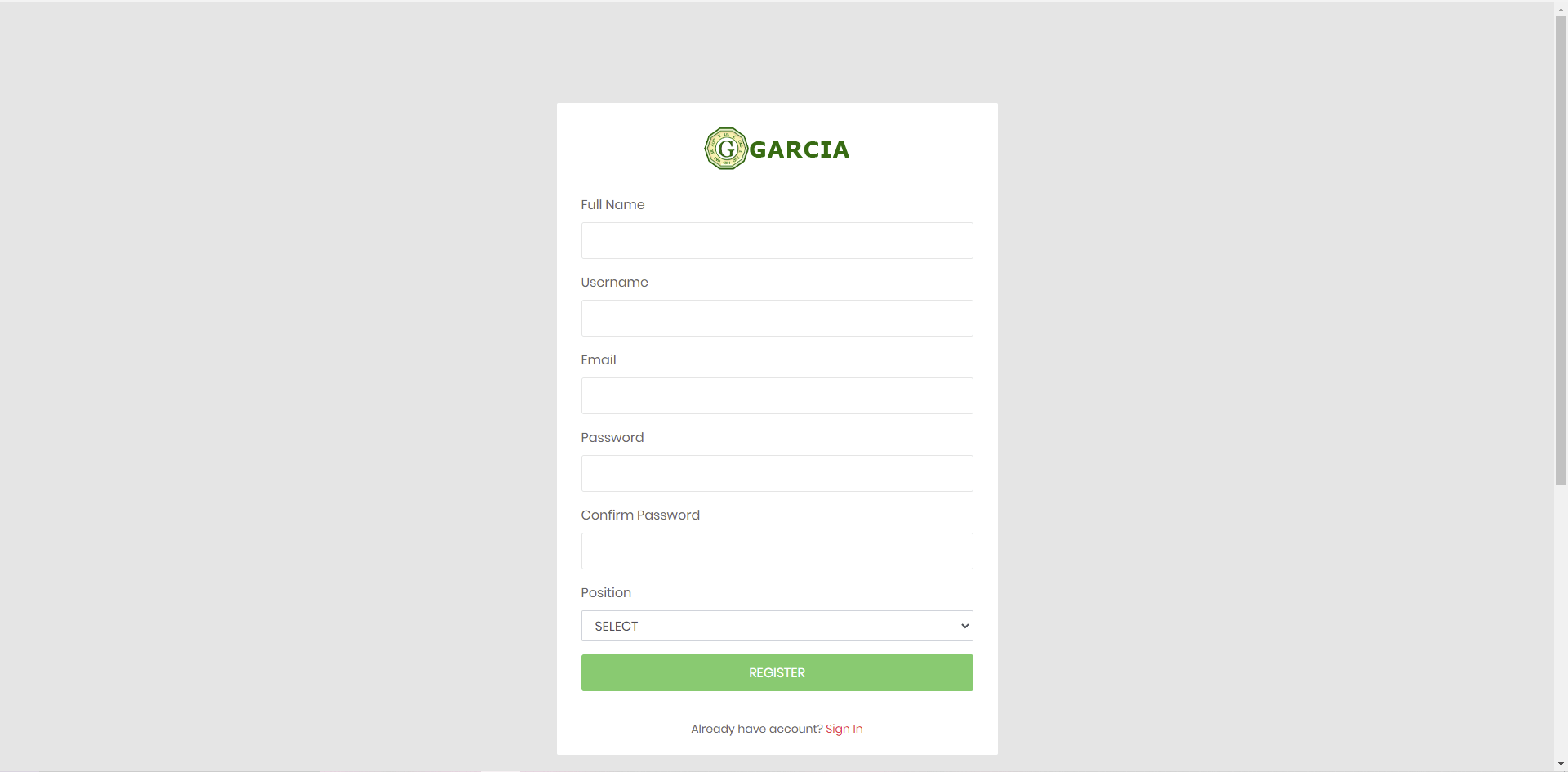

- User Management. The cooperative’s management can designate which of its employees has access to and control over the loan application request. The administrator can add a new user to the system using this module.

- Database Backup Feature – A crucial tool that aids in data protection is the database backup capability. It is an essential step in the management of databases. Data protection and restoration are the goals of database backups. In order to be restored in the event of data loss or corruption, the backup process copies all the data records from one or more tables in a database to another place.

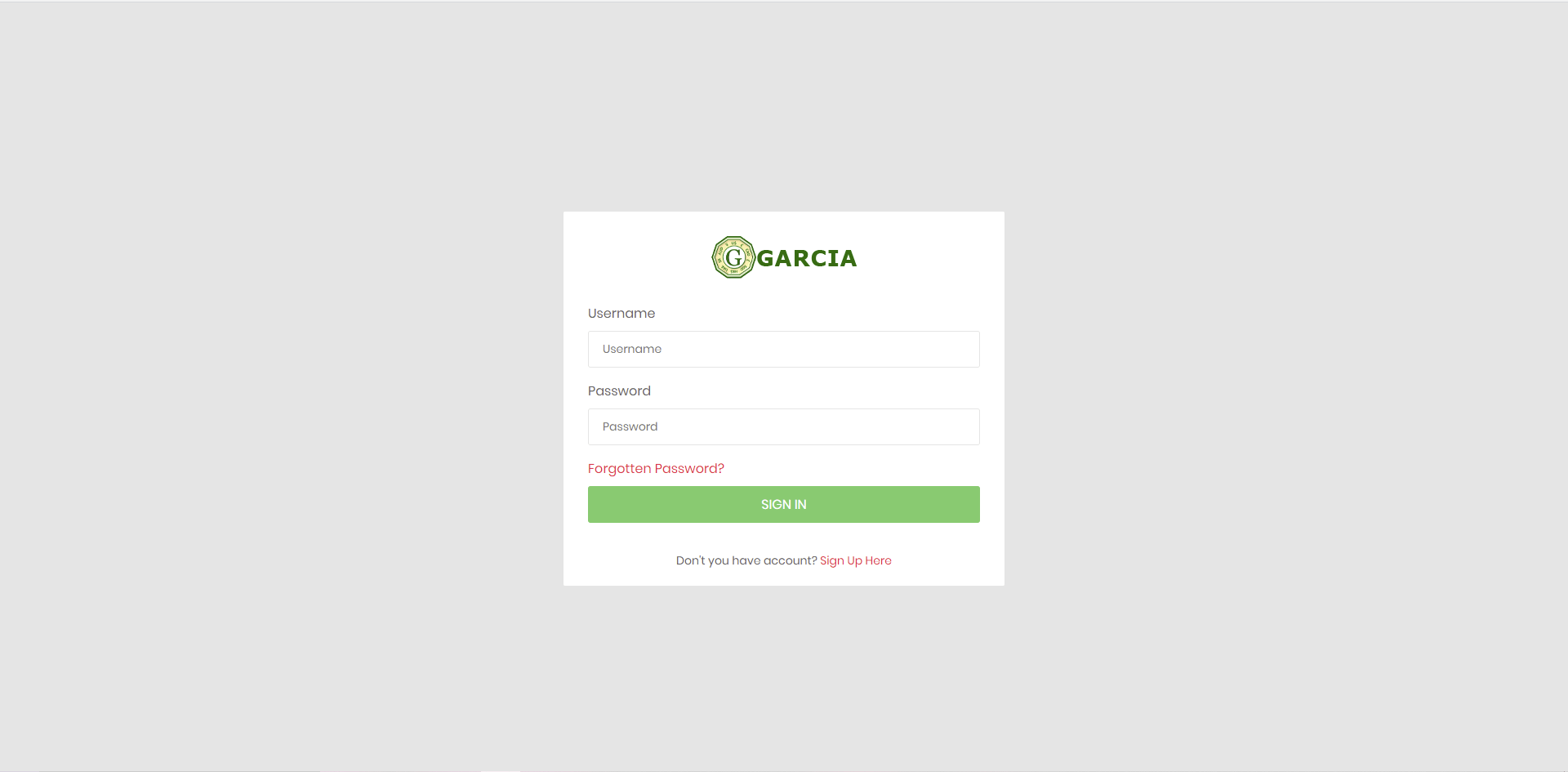

Screenshots

Conclusions

The major goal was to create, develop, and deploy a Cash Loan and Pawning Monitoring System SMS that is simple to use and can send information via text or SMS. The cooperative seeks to automate the procedures for loan and pawn application, approval, payment, and transaction monitoring. As an IT or technology innovators, there is an opportunity to incorporate the usage of technology and software in real-world of business application especially in a cooperative type of organization.

The major objective, which was to transform the manual process into a sophisticated and effective system, was successfully accomplished with good cooperation from both parties. According to the study’s findings based on ratings, the Cash Loan and Pawning Monitoring System SMS offer a simple and practical method of handling loan and pawning operations. The organization is now able to offer their customers a better service thanks to the implementation of this project.

Recommendations

The system has received positive feedback from end users and has passed IT experts’ evaluations, thus the researchers and developers strongly advise putting the system into simultaneous usage. The business should employ technical workers to maintain the system when it is implemented. The cooperative should also set aside money for the installation and upkeep of the aforementioned system. Additional research should be conducted in order to improve the system and add new features.

Summary

The PHP-based Cash Loan and Pawning Monitoring System SMS is a platform that transforms manual processing into a methodical and effective technological form. The system provides loans with incredibly smooth and effective transactions. The system by itself handles all loan and pawn operation processing using manual labor. The use of the platform will reduce the amount of paperwork and transactions involved in cash loans and pawn shop services. Everything will be covered by the system once it is in place. The system will automate transactions and replace or convert the manual loaning process. This system features a capability that may update and send text messages to cooperative members to remind them of their loan and credit due dates. This system can receive and send text messages to cooperative members for updates on their account deposits and for the timing reservation of withdrawals when it is available or not to have their transaction in order to avoid fines. The system provides a variety of functional characteristics that enhance the system’s overall performance. It features a variety of modules, including User Management, Dashboard, Loan Plans, Cash Loan Reports (daily, weekly, and monthly), Loan Management, Pawn Management, and Customer Information Management.

Readers are also interested in:

Loan Management System with SMS Database Design

Loan Management System with SMS Free Bootstrap Template

85 Best Management System Project Ideas

You may visit our Facebook page for more information, inquiries, and comments. Please subscribe also to our YouTube Channel to receive free capstone projects resources and computer programming tutorials.

Hire our team to do the project.