Insurance Management System in Django

Abstract

Table of Contents

Technology is known as the catalyst for change. It transformed almost every aspect of business operations and transactions. Different technologies introduce more advanced and efficient business platforms and techniques that increase the operational efficiencies of businesses. Technology took place in different business industries and institutions. And insurance agencies are no exception.

An insurance agency sells policies to clientele who wanted to be policyholders. An insurance policy can be categorized as life, health, motor, and travel insurance that a client pays to the insurer. Conventionally, insurance agencies operate, market, and transact with clients mostly using manual approaches and with only a little technological intervention.

The capstone project, entitled “Insurance Management System in Django” is a system designed using Django and intended for insurance management automation. The said project will streamline the daily operations of insurance agencies. The software will automate insurance agency management and marketing of policies, clientele transactions, and records management.

The implementation of the system will ease up and simplify the operations and management processes of insurance agencies. The agency can automate recording and storing records of insurance policies, policyholders, and other insurance-related documents. The insurance agent can electronically present insurance policies offered by the agency as well as attend to the inquiries of the clients using the software. Clients also can apply for insurance policies online and the agency can either approve or reject their applications. Overall, the system will make insurance management easy, fast, efficient, accurate, and reliable.

Introduction

The capstone project, “Insurance Management System in Django” is designed to streamline the day-to-day operations and transactions of insurance agencies. The software will introduce marketing automation, customer relationship, and records management of the business.

Conventionally, insurance agencies operate, market, and transact with clients mostly using manual approaches and with only a little technological intervention. Usually, insurance agents and clients personally do transactions where the agent explains to the clients the coverage of the insurance along with the payment required. Insurance agencies manage records of policies, policyholders, and other transactions of the business manually with only a little use of technology. This pre-existing method is prone to difficulties due to physical barriers and time constraints.

Proposed Solution

The development of the Insurance Management System in Django serves as a solution to resolve issues and difficulties in insurance management. The proposed system is designed to streamline the day-to-day operations and transactions of insurance agencies. The insurance agent can electronically present insurance policies offered by the agency as well as attend to the inquiries of the clients using the software. Clients also can apply for insurance policies online and the agency can either approve or reject their applications. Overall, the system will make insurance management easy, fast, efficient, accurate, and reliable.

Objectives of the Study

General Objective – The main goal of the researchers is to design, develop and implement an Insurance Management System that will support the day-to-day operations of insurance agencies and automate management processes.

Specifically, the researchers aim the following objectives:

- To develop a system that will streamline the operation and transactions of insurance agencies.

- To introduce a platform that will automate insurance agency’s marketing.

- To simplify and ease up insurance agency’s data management.

- To introduce electronic encoding of policy form and customer data.

- To reduce manual workloads of insurance agencies.

- To evaluate the system in terms of user acceptability, effectiveness, quality, productivity, and reliability.

Scope of the Study

This study mainly focuses on the implementation of an Insurance Management System in Insurance agencies. The researchers will design software that will digitally transition the daily operations and transactions of the insurance agency. The system will be designed as a platform for insurance management that also permits transactions between the agencies and clients. Insurance agencies and clients will participate as respondents to the study.

Significance of the Study

The success of the project is highly beneficial for the following:

Insurance Agencies. The success of the project will directly benefit insurance agencies. The success of the software will introduce them to a more advantageous platform that will increase their operational efficiency as well as customer relationship.

Clients. Those who wanted to inquire about insurance and be legitimate policyholders can easily and conveniently browse for insurance policies that an insurance agency offered. The software will help them have easy, fast, and efficient transactions with insurance agencies.

Researchers. The researcher’s experience in conducting the study will further harness their skills, knowledge, and potential as programmers and developers.

Future Researchers. They can use the study as their reference in their future pursuit of the same study.

Development Tools

The capstone project “Insurance Management System in Django” is a system that allows insurance agencies to electronically manage the agencies’ insurance policies and records of policyholders and transactions. The software is an online platform to support the day-to-day operations and transactions of insurance agencies.

This article will provide you with an idea on what are the forms to be included in an Insurance Management System in Django. PHP and Bootstrap were used to develop the said template.

Documentation of the project is available upon request (chapters 1 to 5). Feel free to message us for the complete documentation of the project.

Project Highlights

Insurance Management System is a database-driven system that will automate the processes of recording and keeping orderly and accurate insurance processes and transactions.

The advantages of the Insurance Management System are the following:

- Automated management- the system will enable the electronic management of insurance records.

- Records Management – it is a database system that makes the records of insurances electronic, safe, accurate, reliable, and fast.

- Report Generation – the system is capable of generating reports about the records in the insurance agency

How the System Works

This paper will discuss the forms, modules, and user interface of an Insurance Management System. We will discuss the features and how the system works.

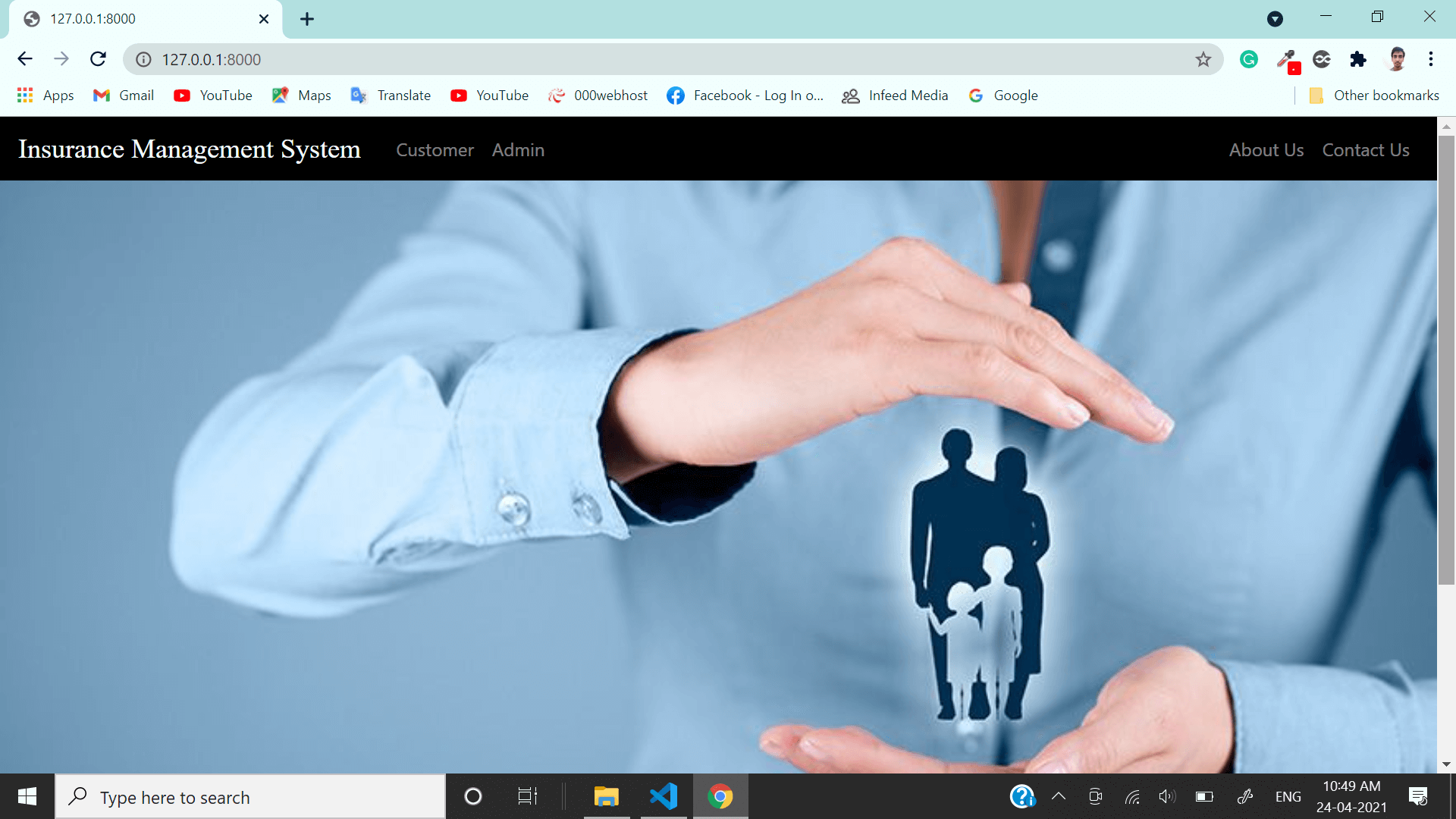

Homepage – this page will is first displayed when the user accesses the system.

The image below is the design of the system’s homepage.

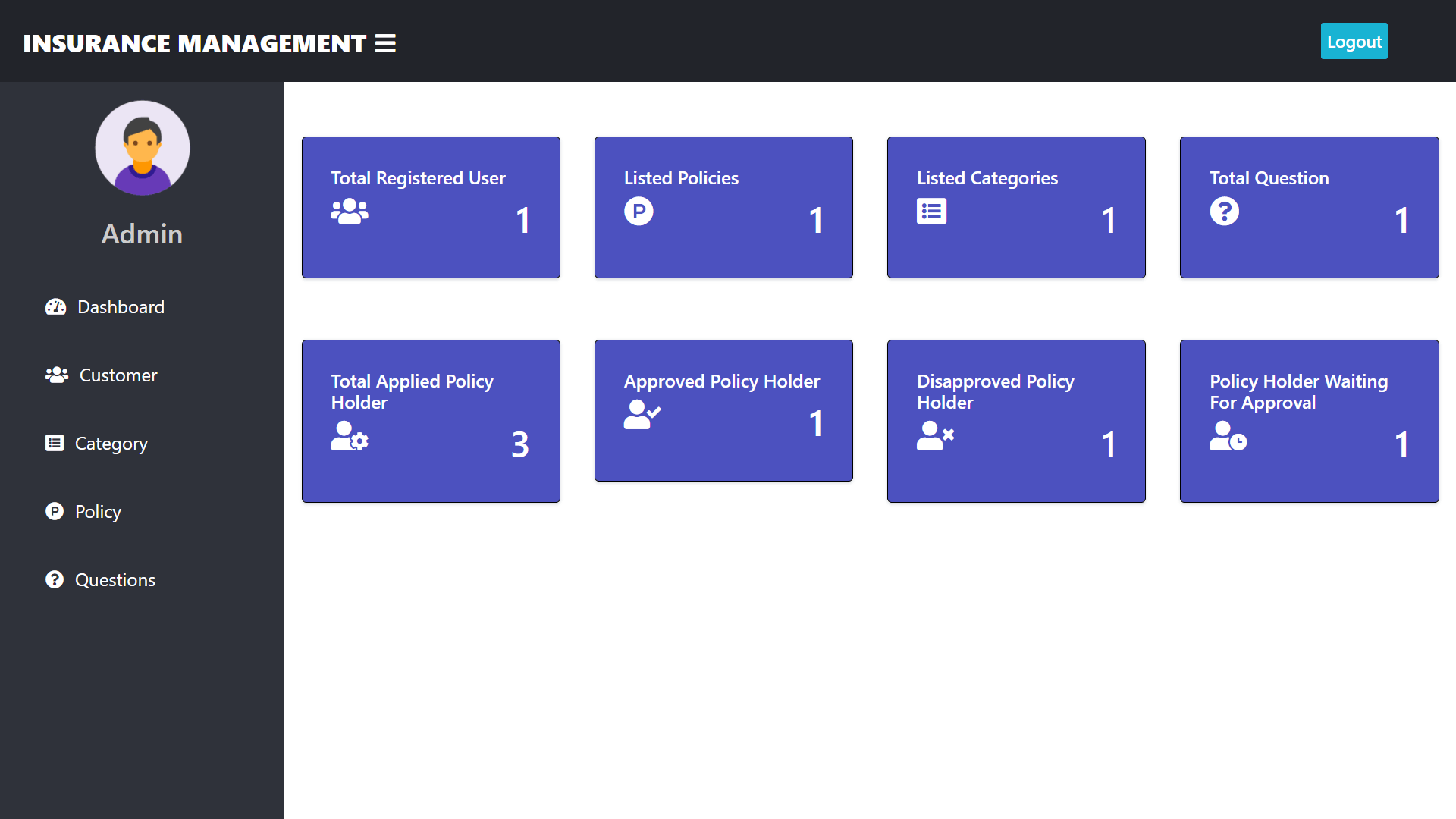

Admin Dashboard – this serves as the main page of the system’s administrator. Insurance-related records are displayed in the dashboard and are managed by the administrator.

The dashboard mainly displays the following information:

- Total Registered Users

- Listed Policies

- Listed Categories

- Total Applied Policy Holder

- Of Approved Policy Holder

- Of Disapproved Policy Holder

- Of Policy Holder Waiting for Approval

Shown below is the design of the administrator’s dashboard.

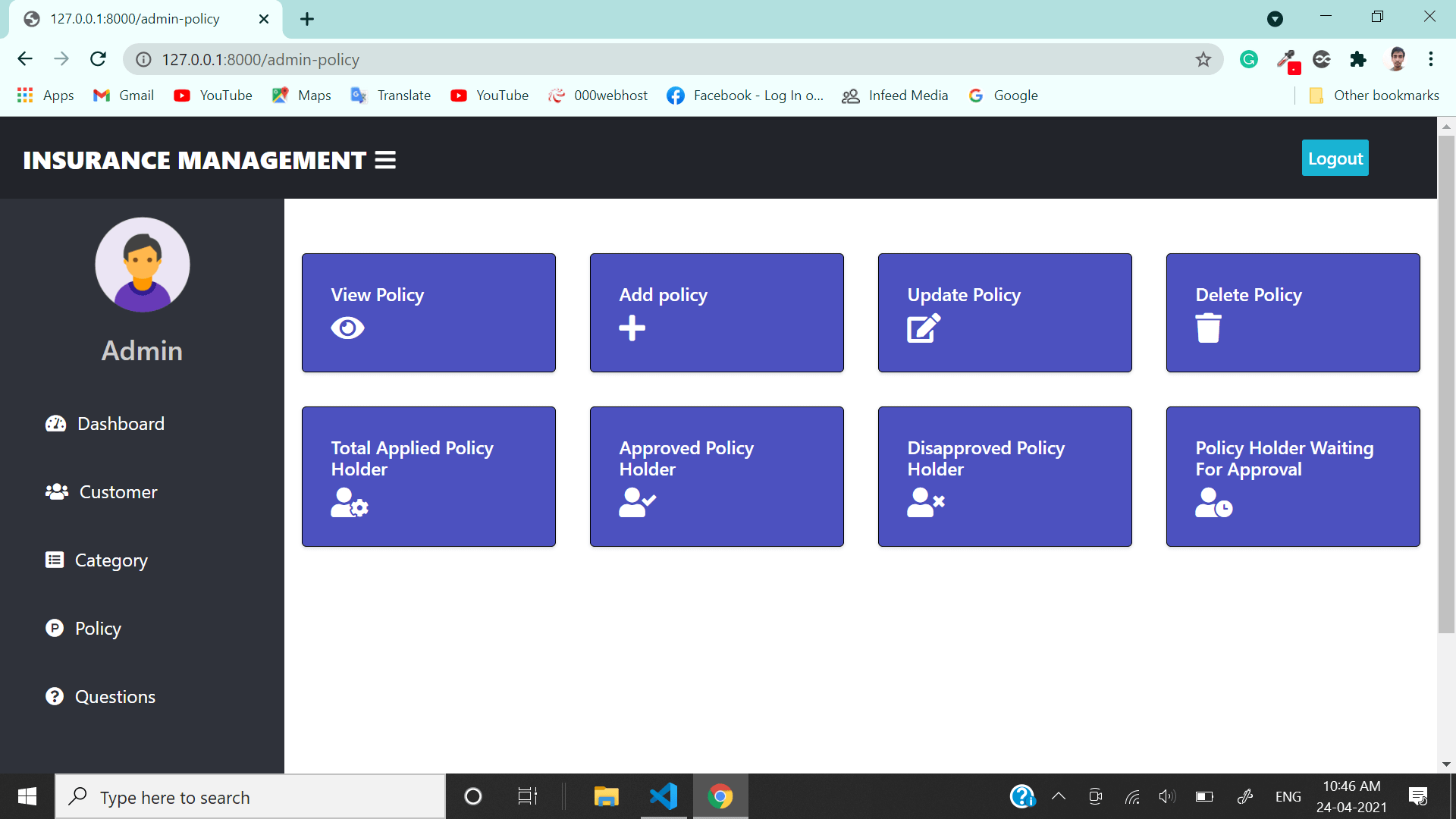

Policy form – this form will allow the admin to manage the listed insurance policies in the system. The admin can view, add, update or delete listed policies.

The following information is encoded and managed by the admin:

- Total Applied Policy Holder

- Approved Policy Holder

- Disapproved Policy Holder

- Policy Holder Waiting for Approval

- Action – (view, add, update, delete)

The image shown below is the design of the Policy form.

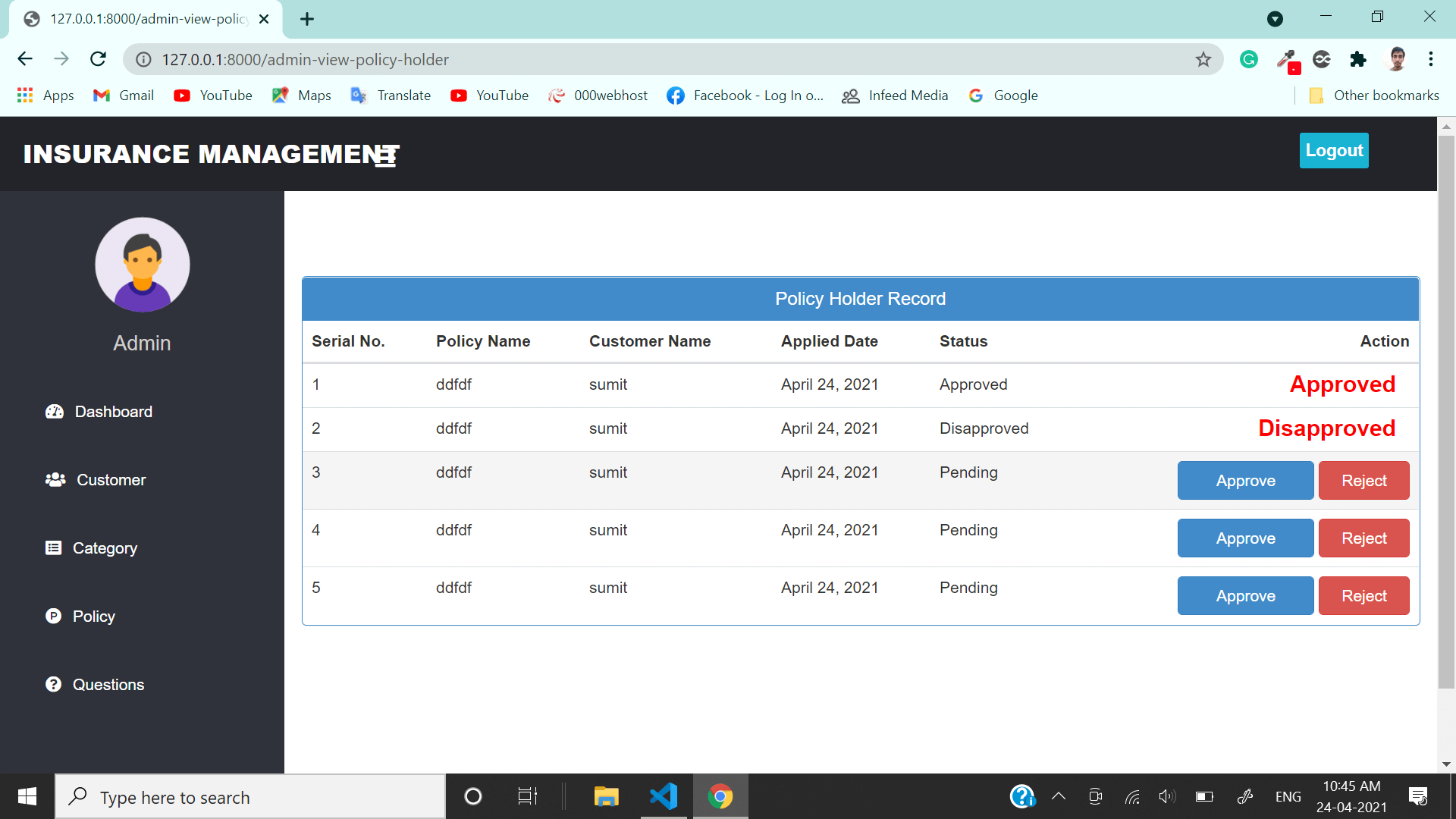

Policy Record – this form will require the admin to encode and manage the records of policies and policyholders.

The admin will encode the following information:

- Serial No.

- Policy Name

- Customer Name

- Applied Date

- Status – ( approved, rejected, pending)

- Action -(approve or reject)

Shown below is the policy record form design.

Conclusion

The tough competition in the insurance businesses market prompted insurance companies and agencies to advance their marketing strategy and management aspects. The researchers conducted the study to develop an Insurance Management System. The developed system was presented to its intended users for assessment. The result of the study showed that the developed system provides the needs and requirements of the respondents and intended users. The majority of the project’s respondents have seen the efficiency and reliability of the system in streamlining insurance management.

Thus, the researchers concluded that the developed system is an effective tool for insurance management. The system will ease up and simplify the operations and management processes of insurance agencies. The agency can automate recording and storing records of insurance policies, policyholders, and other insurance-related documents. The system will make insurance management easy, fast, efficient, accurate, and reliable.

Recommendations

The significant result of the study prompted the researchers to strongly recommend the implementation of the system. The system is highly recommended for its efficiency and reliability that can be rendered to the intended users. The system will improve the operations, services, and overall experience of insurance agency clients and policyholders. The developed system will significantly change the agent-policy holder transaction. The researchers highlight the importance of having enough knowledge on how to properly utilize and operate the system.

The researchers specifically recommend the following:

- The researchers strongly suggest that the system should be used by insurance agencies to advance their business operations, transactions and improve their businesses efficiency.

- The researchers suggest that insurance agency’s clients utilize the software to easily and conveniently apply for an insurance policy.

- The implementation of the system will effectively transform insurance agent-clients transactions.

You may visit our Facebook page for more information, inquiries, and comments.

Hire our team to do the project.

Credits to the developer(s) of the project.

Facebook page: https://www.facebook.com/sumit.luv/

Youtube Video Demo: https://www.youtube.com/watch?v=zq9179Cdblk

Subscribe to their youtube channel: https://www.youtube.com/channel/UCrLWsy9v5KNZU0t0kjQ3Kuw

Download link: https://github.com/sumitkumar1503/insurancemanagement