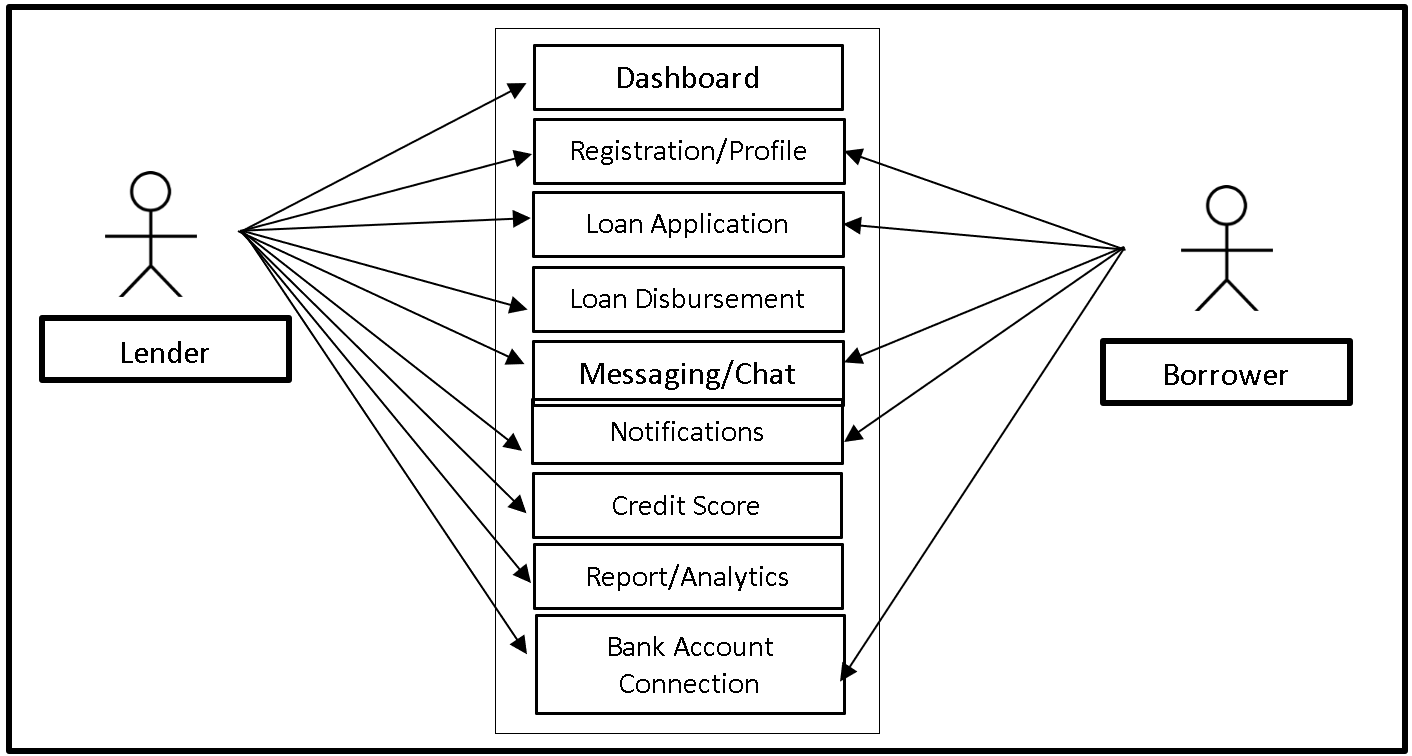

Online Lending System Use Case Diagram

This post presents the use case diagram of the capstone project, Online Lending System Use Case Diagram. The diagram presents the users of the system as well as their roles.

About the Lending System

The proposed system entitled Online Lending Management System aims to make convenience for the transaction involving lending and using this system only requires less effort for the lender, easier and faster to manage. This kind of system will facilitate underwriting of proposals, dynamic uploading of documents, create user accounts and offer a collaboration framework for lenders. The Lending Management System has unique characteristics which are simple, intuitive and proactive and this system handles different types of borrowers and security of users’ documents. Through this system, lending processes will be hassle-free; they will not need to go physically to the lending offices to process but instead they will just utilize this system.

The Online Lending System offers a plethora of benefits that transform the borrowing and lending landscape. It provides unparalleled convenience and accessibility to borrowers, enabling them to apply for loans effortlessly from anywhere. With automated workflows and real-time data processing, loan approvals are expedited, reducing waiting times and enhancing efficiency for both borrowers and lenders. The system’s advanced algorithms ensure more accurate risk assessment and credit scoring, resulting in informed lending decisions and reduced default rates. Transparency is fostered through detailed loan terms and repayment schedules, building trust and stronger customer relationships. Additionally, personalized loan products cater to individual borrowers’ needs, boosting customer satisfaction and loyalty. The Online Lending System streamlines operations for lenders, expands customer reach, and offers a seamless borrowing experience while empowering borrowers with greater financial access and choices.

What is Use Case Diagram?

A use case diagram is a visual representation that illustrates the interactions between users (actors) and the functionalities (use cases) of a system. It provides a clear overview of how users interact with the system to accomplish specific tasks or goals. In the context of the Online Lending System, a use case diagram serves the purpose of defining and understanding the system’s functionalities, user interactions, and requirements.

In the research and software development of the Online Lending System, the use case diagram plays a crucial role by:

- Identifying Actors: It helps in identifying the different actors involved in the lending process, such as borrowers, lenders, administrators, and credit evaluators. By understanding the roles of these actors, developers can design the system to cater to the needs of each user group.

- Defining Use Cases: The use case diagram identifies and defines the specific functionalities that users can perform within the system. Use cases could include applying for a loan, evaluating creditworthiness, approving loans, processing repayments, and generating reports. This helps in capturing all the essential functionalities of the system.

- Modeling Interactions: The diagram shows how actors interact with the system to accomplish various tasks. It illustrates the flow of information and actions between users and the system, helping developers understand the process and interactions required for successful loan processing.

- Requirement Analysis: The use case diagram aids in gathering and validating requirements by capturing user interactions and system functionalities. It helps in understanding the system’s scope and the expectations of stakeholders, ensuring that the final product meets their needs.

- Design and Development: The use case diagram acts as a foundation for system design and development. It provides a blueprint for developers to create the necessary functionalities, user interfaces, and system interactions based on the identified use cases.

The use case diagram facilitates effective communication and collaboration among stakeholders, developers, and designers in the research and software development of the Online Lending System. It ensures that the system aligns with user requirements, streamlines the loan processing workflow, and enhances the overall user experience.

Use Case Diagram

Shown above is the Online Lending System Use Case Diagram. The system has two user sides the Lender who will also act as Administrator and the Borrower of the system. The Lender can access the entire core modules of the system while the Borrower can access the Registration/Profile, Loan Application, Messaging/Chat, Notifications and Bank Account Connection modules of the system.

Note:

Registration

- The borrower creates an account on the online lending platform by providing personal and financial information.

- The system verifies the borrower’s identity and performs necessary background checks.

Credit Score

- If you integrate your app with a credit score service, it will help the users to check their loan eligibility.

Bank Account Connection

- You need to link your bank account with the app so that the loan amount is transferred automatically to your bank, and the app notifies you.

- Similarly, at the time of loan repayment, a fixed amount can be deducted from your bank account automatically on the due date.

Use Cases

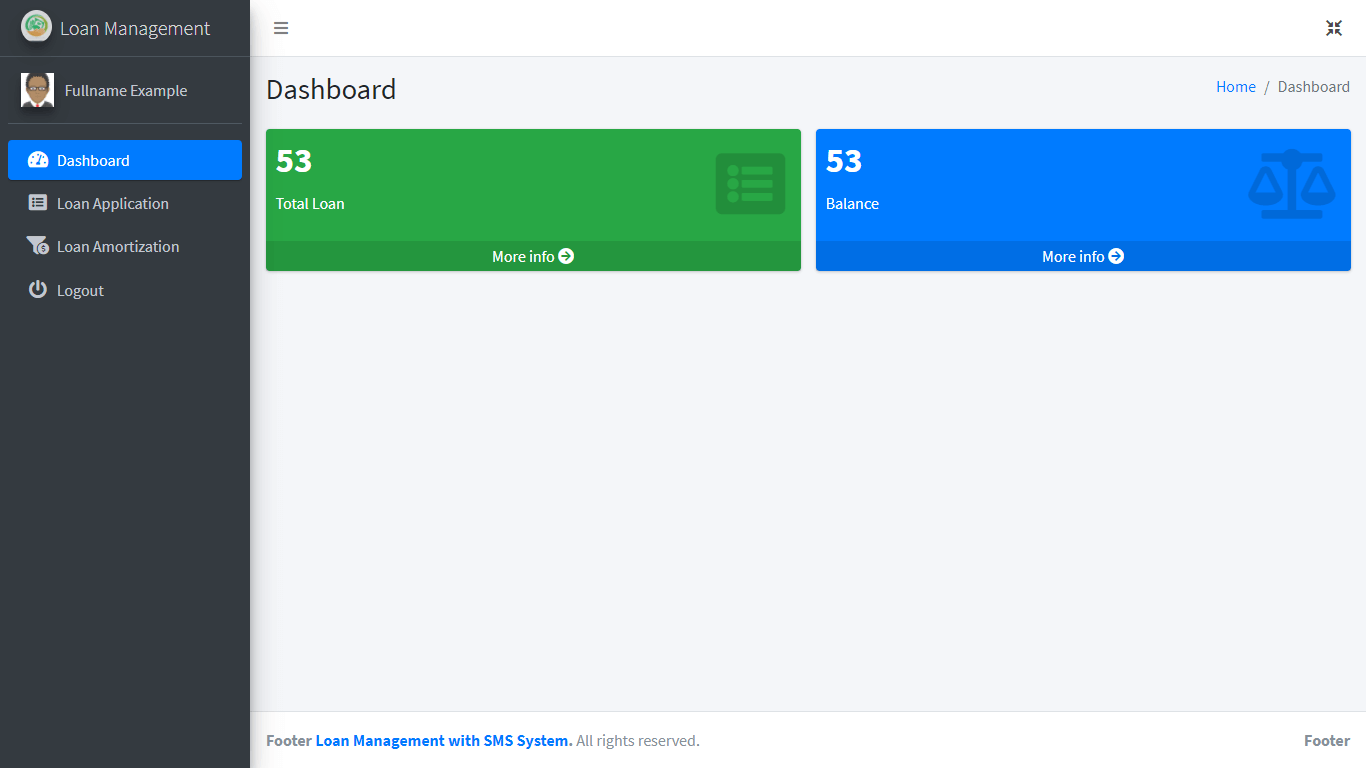

Use Case: Dashboard

Actor(s): Lender

Description: This feature is used to access and manage the information displayed in the dashboard.

Successful Completion:

- The Lender can search, add, update and remove dashboard details.

Alternative: The Lender can access all dashboard details and manage it.

Precondition:

- The Lender will login to access and manage the dashboard.

Post Condition: updated dashboard details

Use Case: Registration/Profile

Actor(s): Lender and Borrower

Description: This feature is used to manage registration of borrower profiles in the system.

Successful Completion:

- The borrower can create an account on the online lending platform and provide necessary information needed for the registration such as personal and financial information.

- The Lender/ System administrator will verify the borrower’s identity and performs necessary background checks before accepting registration.

Alternative: The borrower can register profile while the admin/lender will verify either to accept or reject registration.

Precondition:

- The borrower will need to login first to register an account.

- The lender/admin will need to login first to manage registration of borrowers.

Post Condition: registered or rejected borrowers account registration.

Use Case: Loan Application

Actor(s): Lender and Borrower

Description: This feature is used to manage loan applications of registered borrowers in the system.

Successful Completion:

- The borrower will use this feature to apply for a loan in the Online Lending system.

- The Lender/ System administrator will verify the borrower’s loan application.

Alternative: The borrower can apply for loan while the admin/lender will verify either to accept or reject loan application.

Precondition:

- The borrower will need to login first to apply for loan using the system.

- The lender/admin will need to login first to manage loan applications from borrowers.

Post Condition: accepted or rejected Loan Application

Use Case: Loan Disbursement

Actor(s): Lender

Description: This feature is used to manage the loan disbursement of the borrowers.

Successful Completion:

- The admin can add or update loan disbursement details credited to the borrower’s account.

Alternative: The admin can use this feature to manage the debited and credited amount of loan to the lender and borrower account respectively.

Precondition:

- The admin will login first to manage the Loan Disbursement module.

Post Condition: updated Loan Disbursement

Use Case: Messaging/Chat

Actor(s): Lender and Borrower

Description: This feature is used to manage exchange of messages or chats in the system.

Successful Completion:

- The borrower will use this feature to view messages in their account.

- The Lender/ System administrator can search, add, update or remove messages in the system.

Alternative: The borrower can only send and read messages while the admin/lender can manage all messages or chats in the system.

Precondition:

- The borrower will need to login first to send or read messages from their account using the system.

- The lender/admin will need to login first to manage messages.

Post Condition: updated messages/chats

Use Case: Notifications

Actor(s): Lender and Borrower

Description: This feature is used to manage notifications in the system.

Successful Completion:

- The borrower can receive and view notifications in their account.

- The Lender/ System administrator can search, add, update or remove notifications in the system.

Alternative: The borrower can only receive and view notifications while the admin/lender can manage all notifications in the system.

Precondition:

- The borrower will need to login first to receive and view notifications from their account using the system.

- The lender/admin will need to login first to manage notifications in the system.

Post Condition: updated notifications

Use Case: Credit Score

Actor(s): Lender

Description: This feature is used to manage the credit score service integrated in the app for borrower’s benefit.

Successful Completion:

- The admin can add or update credit score service details.

Alternative: The admin can use this feature to manage credit score services and help borrowers to check their loan eligibility.

Precondition:

- The admin will login first to manage the Credit Score module.

Post Condition: updated Credit Score Service

Use Case: Reports/Analytics

Actor(s): Lender

Description: This feature is used to manage the reports that can be exported from the system.

Successful Completion:

- The admin can generate reports from the system using this feature.

Alternative: The admin can use this feature to export reports generated from the system.

Precondition:

- The admin will login first to generate and print reports.

Post Condition: hard or soft copy of reports

Use Case: Bank Account Connection

Actor(s): Lender and Borrower

Description: This feature is used to manage bank accounts linked to the borrower’s account in the Online Lending System.

Successful Completion:

- The borrower will use this feature to link their bank accounts into their accounts in the system.

- The Lender/ System administrator will manage the bank account connections made by the borrowers.

Alternative: The borrower can only link bank account while the admin/lender will verify bank account connection made.

Precondition:

- The borrower will need to login first to link bank account where loan amount is transferred and will also be used during loan payment.

- The lender/admin will need to login first to manage bank account connections.

Post Condition: updated bank account connections

Summary

In our blog post on the Online Lending System Use Case Diagram, we explore the power of visual representation in understanding the interactions and functionalities of this cutting-edge lending platform. The use case diagram serves as a crucial tool in defining the roles of different actors, such as borrowers, lenders, and administrators, and capturing essential functionalities like loan applications, credit evaluations, and loan approvals. We delve into the significance of this diagram in requirement analysis, system design, and development, ensuring seamless borrower experiences and efficient loan processing. Join us to discover how this diagram acts as a blueprint for the Online Lending System, aligning it with user needs and streamlining the lending workflow for a smoother, transparent, and personalized borrowing journey.

Readers are also interested in:

Loan Management System with SMS Database Design

35 Best Java Project Ideas with Database

You may visit our Facebook page for more information, inquiries, and comments. Please subscribe also to our YouTube Channel to receive free capstone projects resources and computer programming tutorials.

Hire our team to do the project.